It’s a shipping stock. Heading into a slowdown, prices of the stock have come way off their highs. Next year’s consensus numbers are all over the place. From $-8 to $8!!! Do you think after divesting the dividend it’s a worthwhile stock to own? Does its current price represent a good valuation on future earnings? I really only have questions right now…

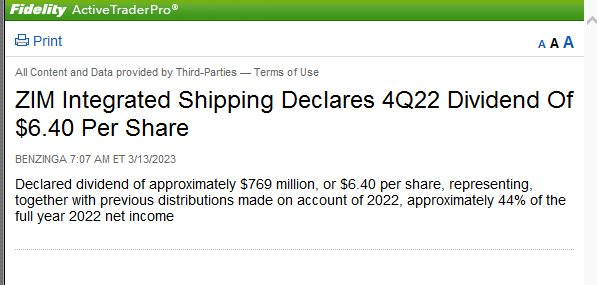

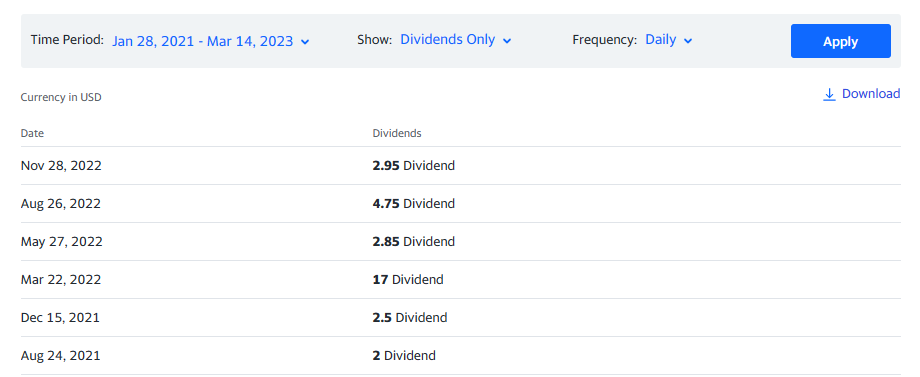

That’s some dividend payout. But please remember that the stock has only traded for less than 2 years. The tally is: 2021 (y1) $24.35 and for trailing 12 months: $29.55.

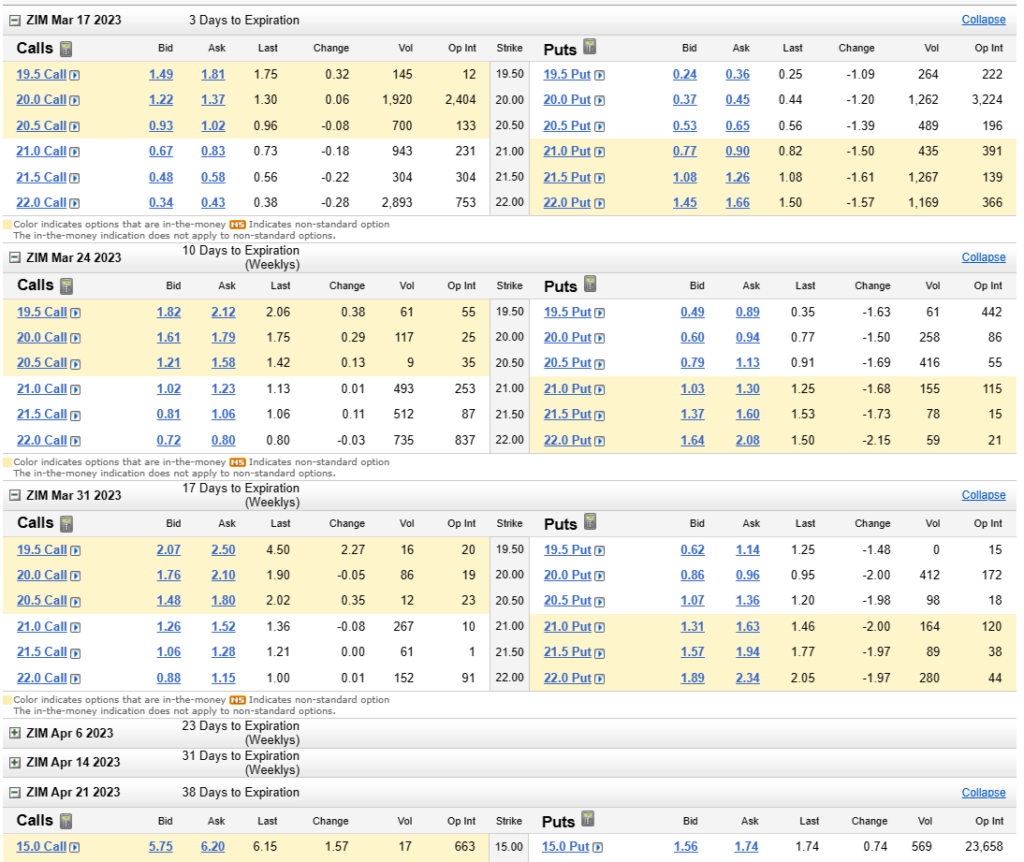

In yesterday’s trading, it soared over $24 before settling back. How are the options? Let’s take a look. Well, there is some depth at the ATM options and OTM which is reassuring (unlike Dropbox).

Given my track record on owing odd stocks… I’m tempted to ignore it. But with a beta of 2 and short interest approaching 20%, I can sure see why premiums are as high as they are. So it’s a gamble.